Chainlink has been a crucial middleware in the crypto industry, especially within the DeFi sector, acting as a bridge between on-chain dapps and external data sources. However, despite its importance, the native token LINK has faced challenges in gaining momentum recently.

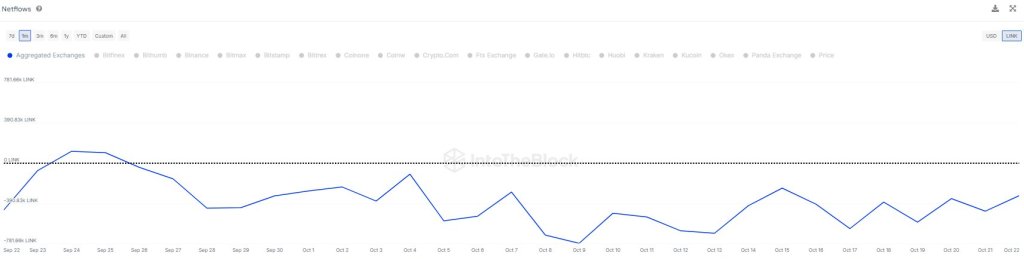

Recent data from IntoTheBlock suggests that a growing number of LINK holders are withdrawing tokens from major exchanges like Binance and Coinbase. This trend of negative exchange flow indicates that these holders may be accumulating tokens outside of centralized platforms, possibly to engage with DeFi protocols and earn passive income.

The increase in transfers from centralized exchanges could potentially lead to a price surge for LINK, benefiting bullish investors. Currently, Etherscan data shows that there are over 721,996 unique addresses holding a total supply of 1 billion LINK tokens.

Furthermore, the launch of Chainlink Labs’ Cross-Chain Interoperability Protocol (CCIP) Private Transactions highlights the ongoing development efforts within the Chainlink ecosystem. This new feature enhances data privacy for cross-chain transactions, showcasing the platform’s commitment to innovation and expansion.

In terms of price action, the resistance for LINK stands at $12.3, with a potential breakout above $13 paving the way for a rally towards $20. However, the pace of this growth will also depend on the performance of key altcoins like Ethereum, which could catalyze demand for DeFi projects and subsequently boost LINK’s value.

Overall, the recent behavior of LINK holders and the developments within the Chainlink ecosystem indicate a potential resurgence in momentum for the token, suggesting that bullish sentiment may soon return to the market.

Source link