This article is also available in English.

Solana continues to prove that it’s one of the top blockchains for this cycle. After its rally, which gained 35% over the past 60 days, the popular Layer 1 blockchain is back in the news with more on-chain activities.

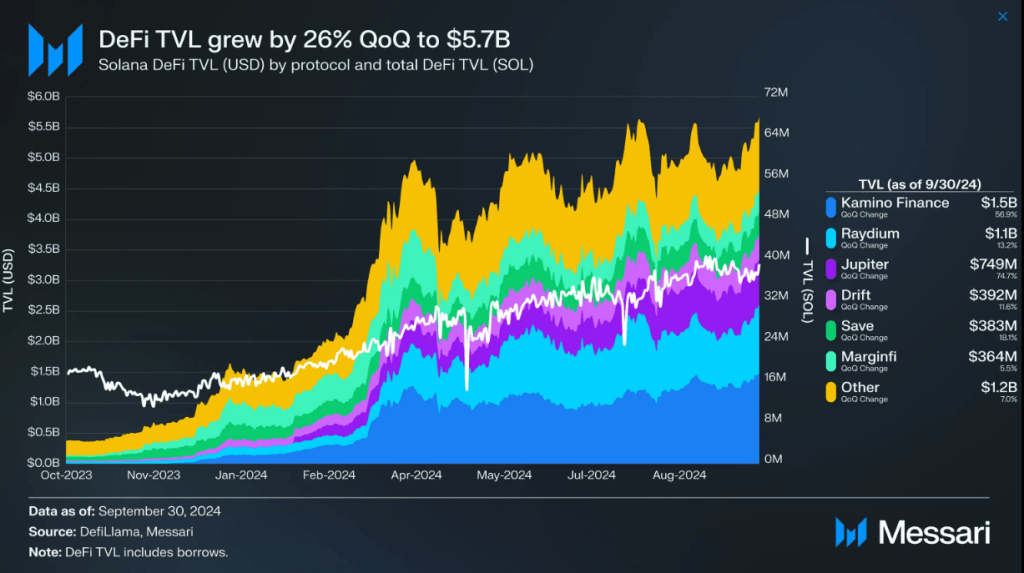

According to recent data, Solana’s DeFi Total Value Locked or TVL increased to $5.7 billion in the third quarter, reflecting a 26% improvement from the previous quarter.

Related Reading

Kamino, a crypto lending service, leads the count with $1.5 billion in TVL and an impressive 7% Quarter-on-Quarter growth, helped by jupSOL and PYUSD additions. Recent data also suggests that Solana’s market cap is now $3.8 billion, an improvement of 23%, boosted by the integration of PayPal’s PYUSD.

The significant contributions from Kamino, particularly its $1.5 billion in TVL and steady growth, highlight the diverse ecosystem of projects utilizing Solana’s platform. The integration of jupSOL and PYUSD further strengthens Solana’s market cap, showcasing a strategic partnership with PayPal. This collaboration not only elevates Solana’s position in the market but also enhances its reputation as a trusted blockchain network for financial transactions.

DeFI Continues To Drive Growth For Solana

Solana DeFi tops the chain’s activities with a total locked value, worth $5.7 billion. This latest SOL data reflects a solid 26% growth QoQ, pushing the blockchain to become third largest in this metric, surpassing Tron.

The dominance of Solana in the DeFi space, as evidenced by the $5.7 billion total locked value, underscores the platform’s robust decentralized finance offerings. Surpassing Tron in this metric signifies Solana’s increasing relevance and appeal to users seeking innovative financial solutions. The 26% quarter-on-quarter growth further solidifies Solana’s position as a key player in the DeFi ecosystem, setting the stage for continued expansion and development within the network.

In a Messari report, Solana’s TVL increased due to increased activities for Kamino, which accounted for $1.5 billion of the total contracts locked. Kamino’s recent quarterly figure represents a 57% rise, thanks to the recent integration of jupSOL and PYUSD.

The collaboration between Solana and Kamino, resulting in $1.5 billion of total contracts locked, showcases the potential for growth and innovation within the ecosystem. The utilization of jupSOL and PYUSD signifies the continuous expansion of DeFi offerings on Solana, attracting a diverse range of users and projects to the platform. This strategic integration contributes to Solana’s overall market cap growth and solidifies its position as a leading blockchain network for decentralized finance applications.

Solana’s impressive growth in TVL showcases its strength as a blockchain network, positioning it as a key player in the current market cycle. The 35% increase in value over the past 60 days demonstrates investor confidence in Solana’s capabilities. The rise in TVL to $5.7 billion highlights the growing interest in decentralized finance on the platform, indicating a positive trend for Solana’s adoption and utility.