A Beginner’s Guide to Bitcoin Mining

In recent years, the world of cryptocurrency has gained significant attention and popularity, thanks to its decentralized nature and potential for enormous profits. One of the most intriguing aspects of cryptocurrency is the process of mining, which helps secure and maintain the blockchain network. If you’re new to the world of cryptocurrency, particularly Bitcoin, here is a beginner’s guide to Bitcoin mining.

What is Bitcoin mining?

Bitcoin mining is the process of validating and adding new transactions to the blockchain ledger. Miners compete to solve complex mathematical problems using powerful computer hardware, leading to the creation of new Bitcoin and the verification of transactions. These miners contribute their computational power to the network and ensure the integrity and security of the Bitcoin system.

How does it work?

Bitcoin mining involves solving complex mathematical puzzles through an algorithm called Proof of Work (PoW). Miners have to find the correct solution to these puzzles by assembling numerous attempts per second with powerful hardware. The solutions found are then bundled together with other validated transactions to form a new block added to the blockchain.

To incentivize the miners for their efforts, they are rewarded with newly minted Bitcoins and transaction fees paid by those using the Bitcoin network. The reward is halved approximately every four years, through an event known as the Bitcoin halving. This process encourages miners and ensures the sustainability of the network.

What do I need to mine Bitcoin?

To start mining Bitcoin, you need three essential components: hardware, software, and a Bitcoin wallet.

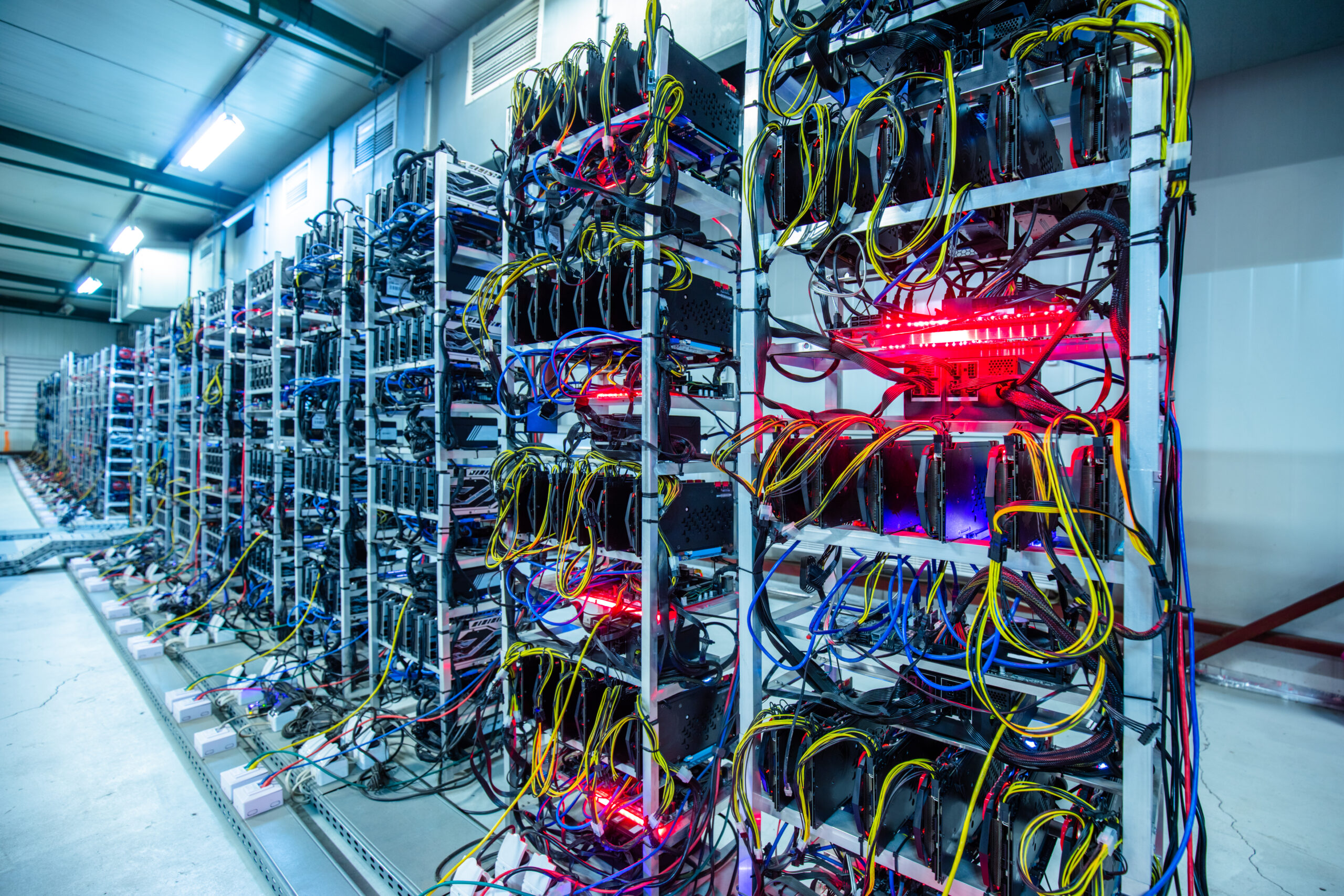

- Hardware: Bitcoin mining requires specialized hardware to solve the complex puzzles effectively. In the early days, mining could be done using a regular personal computer, but with the increasing difficulty, miners switched to using more powerful devices called ASICs (Application-Specific Integrated Circuits). These devices are specifically designed for Bitcoin mining and offer much higher computational power and energy efficiency than conventional hardware.

- Software: Once you have the hardware, you’ll need mining software. The software connects your hardware to the Bitcoin network and allows you to control and monitor the mining process. Popular mining software includes CGMiner, BFGMiner, and EasyMiner.

- Bitcoin Wallet: To receive your mining rewards and store your Bitcoin, you need a Bitcoin wallet. There are various types of wallets available, including online, hardware, and software wallets. Choose a wallet that suits your preferences and provides the right balance of security and accessibility.

Joining a mining pool

Solo mining, where an individual miner mines alone, has become less profitable over time due to the increasing difficulty of mining and competition among miners. To circumvent this, many miners join mining pools, where miners pool their resources and share the block rewards according to their contributed computational power. Joining a mining pool allows for more consistent rewards and reduces the risk of high electricity costs associated with solo mining.

Bitcoin mining is a complex and competitive process that plays a crucial role in maintaining the Bitcoin network. While it may seem overwhelming at first, with the right hardware, software, and a little technical know-how, anyone can get started with Bitcoin mining. However, it’s important to consider factors like high electricity costs, hardware expenses, and the potential risks involved before diving into this exciting world of cryptocurrency mining.

The article above provides a comprehensive beginner’s guide to Bitcoin mining. It covers the essential aspects of what Bitcoin mining is, how it works, the required components, and the importance of joining mining pools. The guide effectively introduces newcomers to the concept of cryptocurrency mining and provides valuable insights into the technical and practical aspects of getting started.

Potential Risks in Bitcoin Mining

Bitcoin mining, while potentially lucrative, comes with a range of risks and challenges that individuals should be aware of before getting involved. Here are some of the main risks and challenges associated with Bitcoin mining:

- Volatility of Bitcoin Price: The value of Bitcoin is known for its extreme volatility. If the price of Bitcoin drops significantly after you’ve invested in expensive mining hardware and incurred operational costs, your profitability could be compromised, and you might struggle to cover your expenses.

- High Initial Investment: Mining requires a substantial upfront investment in specialized hardware, which can be quite expensive. As technology advances, new and more efficient hardware is developed, making older models less competitive and potentially obsolete.

- Operating Costs: Running mining hardware requires a significant amount of electricity. Depending on your location and energy costs, the expenses related to electricity consumption could cut into your profits or even lead to financial losses.

- Competitive Mining Environment: The Bitcoin network adjusts the mining difficulty level approximately every two weeks to maintain an average block creation time of 10 minutes. This means that as more miners join the network, the difficulty increases. Increased difficulty results in higher computational requirements and a decrease in profitability, making it harder to compete.

- Hardware Limitations and Failures: Mining hardware is subject to wear and tear, and components can fail. This could lead to downtime and additional costs for repairs or replacements.

- Regulatory and Legal Concerns: The legal and regulatory environment for cryptocurrency mining varies from country to country and can impact your ability to operate. Changes in regulations could affect your mining operations or even render them illegal.

- Lack of Control over Network Changes: The Bitcoin protocol is subject to updates and changes. While changes are typically made to improve the network, they could also introduce changes that affect your mining setup, potentially requiring hardware upgrades or software adjustments.

- Environmental Impact: The energy-intensive nature of Bitcoin mining has raised concerns about its environmental impact. Mining operations can consume a significant amount of electricity, contributing to carbon emissions and potentially drawing criticism from environmentally conscious individuals.

- Market Saturation: The increasing popularity of Bitcoin mining has led to market saturation in some regions. This saturation can lead to reduced profitability as more miners compete for rewards.

- Security Risks: Mining requires the use of specialized software and connections to the internet. These factors can expose your mining operations to security risks, such as hacking attempts or malware infections.

- Uncertain Long-Term Viability: As the cryptocurrency landscape evolves, it’s unclear how long Bitcoin mining will remain profitable or even necessary. Technological advancements and changes in consensus mechanisms could impact the role of mining in the network’s security.

Given these risks and challenges, it’s essential if you’re considering Bitcoin mining to conduct thorough research, calculate potential costs and profits, and evaluate your risk tolerance. While mining can be a rewarding project, you should approach it with caution and a clear understanding of the associated risks.

Environmental concerns around bitcoin mining

Bitcoin mining has raised significant environmental concerns due to its energy-intensive nature. The process of mining, especially under the Proof of Work (PoW) consensus algorithm, requires immense computational power, which translates into high energy consumption. Here are the main environmental concerns associated with Bitcoin mining:

- Energy Consumption: Mining involves solving complex mathematical puzzles, which requires powerful hardware running at full capacity. This leads to a substantial energy consumption, often comparable to that of small countries or even larger. The energy demands of mining can contribute to greenhouse gas emissions and put pressure on energy resources.

- Carbon Emissions: The energy consumption associated with Bitcoin mining directly contributes to carbon emissions, which are a major contributor to climate change. Regions that rely heavily on coal or other fossil fuels for electricity generation can have particularly high carbon footprints from mining activities.

- E-Waste: As mining hardware becomes obsolete due to increasing mining difficulty or technological advancements, it can lead to a significant amount of electronic waste (e-waste). Proper disposal and recycling of these devices become crucial to minimize the environmental impact.

- Electronic Waste: As mining hardware becomes obsolete due to increasing mining difficulty or technological advancements, it can lead to a significant amount of electronic waste (e-waste). Proper disposal and recycling of these devices become crucial to minimize the environmental impact.

- Resource Depletion: The production of mining hardware requires the extraction of raw materials, including metals and minerals. This can contribute to resource depletion and environmental degradation in regions where these materials are extracted.

- Electricity Grid Strain: In some areas, large-scale mining operations can strain local electricity grids, leading to increased demand for energy and potential power outages. This can impact both the environment and local communities.

- Mining Farm Locations: Miners often seek locations with cheap electricity to maximize profits. This can lead to increased strain on local energy resources and infrastructure in those areas.

- Conflict with Renewable Energy Goals: Some regions that aim to transition to renewable energy sources may find their efforts hindered if large amounts of electricity are diverted to power energy-intensive mining operations.

- Public Perception: The environmental concerns associated with Bitcoin mining have led to negative public perception, especially from those concerned about climate change and sustainability. This perception could impact the wider adoption and acceptance of cryptocurrencies.

Efforts to Address Environmental Concerns:

- Transition to Proof of Stake (PoS): Some cryptocurrencies are moving away from PoW to PoS consensus algorithms. PoS requires validators to hold a certain amount of the cryptocurrency, reducing the need for energy-intensive calculations.

- Renewable Energy Usage: Some mining operations are actively seeking ways to use renewable energy sources, such as solar, wind, or hydroelectric power, to mitigate their carbon footprint.

- Energy Efficiency: Hardware manufacturers are striving to develop more energy-efficient mining hardware to reduce energy consumption while maintaining mining profitability.

- Regulatory Measures: Some governments and regulatory bodies are considering or implementing regulations to address the energy consumption and environmental impact of cryptocurrency mining.

- Carbon Offsetting: Some mining operations are exploring options for carbon offsetting, where they invest in environmental initiatives to balance out their carbon emissions.

As the cryptocurrency landscape continues to evolve, the industry is becoming increasingly aware of the environmental concerns associated with Bitcoin mining. Efforts are being made to address these concerns and develop more sustainable practices within the mining sector.

Check more articles: Cryptocurrency ; Buy; sell with Popular Crypto software!