The price of Ethereum has experienced a downward correction after failing to break the $1,670 resistance level. It is currently trading below $1,640 and the 100-hourly Simple Moving Average. A key bearish trend line is forming with resistance near $1,640. To see another increase, Ethereum must stay above the $1,600 support zone. If it fails to do so, it could experience further declines, with the next major support levels at $1,540 and $1,500. The MACD and RSI indicators are also showing bearish signals. The main resistance is forming near $1,660.

This article originally appeared on www.newsbtc.com

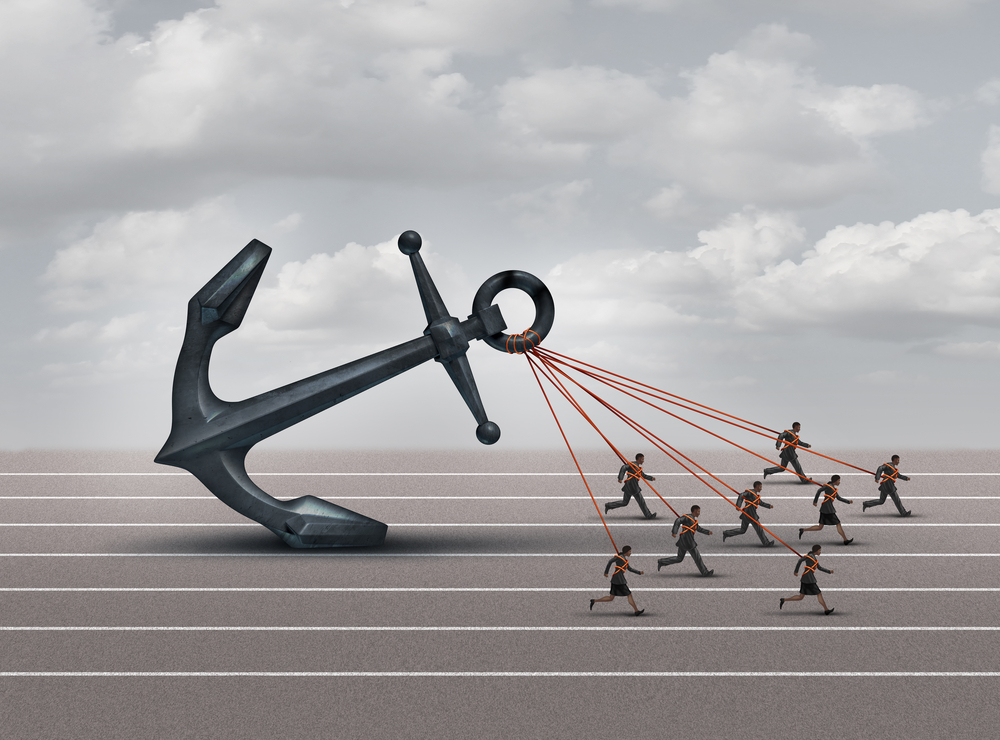

The price of Ethereum, the world’s second-largest cryptocurrency, has been on a steady decline lately. However, despite this downward trend, key support levels are still holding strong.

At the time of writing, Ethereum is trading below the $3,000 mark, hovering around $2,900. This represents a significant drop from its all-time high of over $4,000, reached in early May. The decline is part of a broader market correction, with most cryptocurrencies experiencing similar pullbacks.

One of the main factors contributing to Ethereum’s recent decline is the overall market sentiment. There has been a general shift in investor behavior, as fears of a regulatory crackdown on cryptocurrencies have intensified. This has led to increased selling pressure and a bearish sentiment in the market.

However, despite the negative sentiment, there are still strong support levels holding up. The $2,800 level has proven to be a major support area, with multiple tests and bounces off this level in recent weeks. This indicates that there is still significant buying interest at this price level, which is a positive sign for Ethereum’s long-term outlook.

Furthermore, Ethereum’s network fundamentals remain strong. The Ethereum blockchain is widely used for decentralized applications (dApps) and smart contracts, and its ecosystem continues to grow. The recent London hard fork upgrade introduced the highly anticipated EIP-1559, which aims to improve the transaction fee structure and reduce Ethereum’s supply inflation. This upgrade has been well received by the community and could potentially drive further adoption and price appreciation.

In addition, Ethereum’s upcoming shift to a proof-of-stake consensus mechanism with the Ethereum 2.0 upgrade could have a positive impact on its price. This transition is expected to make the network more energy-efficient and scalable, which would address some of the current criticisms of the Ethereum blockchain. If successful, it could attract more investors and drive up demand for Ethereum.

Overall, while Ethereum’s price has been grinding lower recently, key support levels have remained intact. The strong buying interest at these levels, coupled with positive network developments, suggests that Ethereum’s long-term outlook remains favorable. However, it is important for investors to remain cautious and monitor the market closely, as regulatory concerns and market volatility could continue to impact prices in the short term.

Source link