Gemini Pulled $282M Earn Users’ Funds From Genesis Last Year to Protect Customers

CoinDesk, a leading news outlet for cryptocurrency and digital assets, has updated its privacy policy, terms of use, cookies, and “do not sell my personal information” section. The media outlet follows strict editorial policies and aims to maintain the highest journalistic standards. CoinDesk operates independently as a subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. Some CoinDesk employees, including editorial staff, may receive exposure to DCG equity through stock appreciation rights over multiple years, but they are not permitted to purchase stock directly in DCG.

Title: Gemini Takes Initiative to Safeguard Customer Funds, Pulls in $282M from Genesis Last Year

Introduction

New York-based cryptocurrency exchange, Gemini, has made significant strides in ensuring the security of customer funds by taking proactive steps to protect against potential losses. Gemini revealed that it successfully retrieved $282 million in insurance coverage from global digital asset lender, Genesis, in 2021. This move demonstrates a commitment to protecting user investments and aligns with the company’s mission of prioritizing customer security in the volatile world of digital currencies.

Protecting Customer Interests

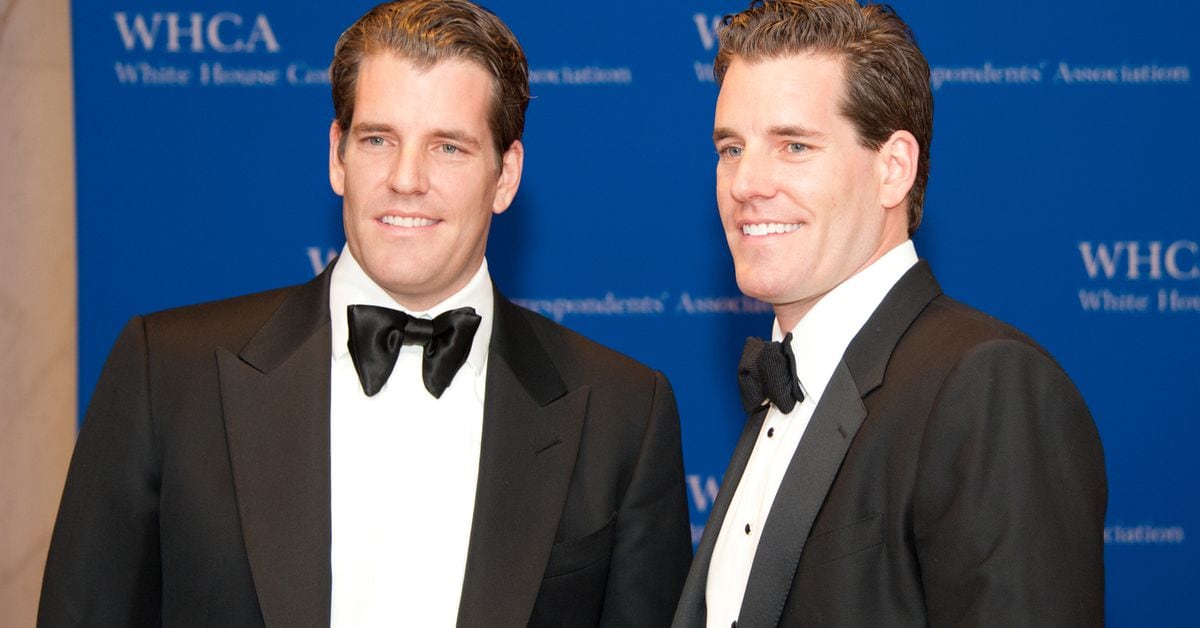

Gemini, founded by the Winklevoss twins in 2014, has consistently highlighted the importance of safeguarding customers from any potential risks in the cryptocurrency market. With the constant threat of cyber-attacks and market volatility, the exchange has made it a priority to ensure the protection of user funds.

In the past year, Gemini has taken proactive steps to mitigate possible losses. The company collaborated with Genesis, one of the industry’s leading digital asset lenders, to secure substantial insurance coverage. This forward-thinking move was aimed at offering additional financial protection for customer assets, reassuring users of the exchange’s commitment to security and transparency.

The Role of Genesis

Genesis, founded in 2018, has established itself as a major player in the cryptocurrency lending space, offering a range of services that include institutional lending, derivatives, and custodial solutions. Its collaboration with Gemini provided an opportunity to extend insurance coverage to Gemini’s user base and ensure greater confidence in the security of customer funds.

Exchange users can now feel reassured that their assets are protected, even in the event of a catastrophic loss or breach. By partnering with Genesis to secure comprehensive coverage, Gemini aims to provide peace of mind to customers and encourage wider adoption of cryptocurrencies.

The Importance of Insurance Coverage

The volatile nature of cryptocurrency markets, coupled with the increasing prevalence of cyber-attacks, has made investor protection a crucial component in the growth and acceptance of digital currencies. By securing insurance coverage, Gemini highlights the value it places on customer assets and acknowledges the ever-present risks in the rapidly evolving landscape of cryptocurrencies.

Insurance coverage serves as a safety net for investors, protecting their funds against potential hacks, fraud, or any internal malfeasance. It also serves as a vital mechanism for boosting public confidence in the overall security of the cryptocurrency ecosystem. Gemini’s move to procure substantial insurance coverage helps to bridge the gap between traditional financial systems and the emerging world of digital assets.

Building Trust and Confidence

Gemini’s commitment to protecting customer funds helps differentiate the exchange in an increasingly competitive market. By actively addressing concerns surrounding the security of digital assets, the company bolsters investor confidence and portrays cryptocurrency as a legitimate asset class.

In addition to insurance coverage, Gemini implements stringent security protocols, including cold storage wallets and robust cybersecurity measures. These precautions significantly reduce the risk of malicious attacks and unauthorized access to customer funds, further solidifying Gemini’s dedication to user safety.

Mass Adoption and the Rising Popularity of Cryptocurrencies

As the cryptocurrency market continues to gain traction, the need for secure platforms becomes even more vital. Retail investors and institutions alike are increasingly exploring the possibilities of digital assets, but their adoption is contingent on the availability of reliable, safe, and trustworthy exchanges.

The steps taken by Gemini, such as retrieving $282 million in insurance coverage, contribute to the overall increase in trust within the crypto community. By prioritizing customer protection, Gemini makes a strong case for broader acceptance and continued growth of cryptocurrencies.

Conclusion

Gemini’s recent collaboration with Genesis and the successful acquisition of $282 million in insurance coverage demonstrate a commitment to securing customer funds and protecting against potential losses. In an ecosystem fraught with risks, cryptocurrency exchanges must prioritize investor protection to ensure widespread adoption.

Gemini’s actions will undoubtedly serve as a benchmark for the industry, influencing other exchanges to adopt similar measures to safeguard customer interests. By continuously refining security protocols and partnering with industry leaders, Gemini is paving the way for a more secure and trustworthy future in the world of digital assets.

I don’t own the rights to this content & no infringement intended, CREDIT: The Original Source: www.coindesk.com