Injective has garnered significant interest from investors due to the ongoing on-chain developments on the platform. These advancements and information releases have sparked excitement among investors, leading to a price increase of over 21% for the token. The continuous positive developments are expected to propel the value of INJ further on the bullish path.

Related Reading

Injective’s investors and traders have recognized the platform’s strong potential, establishing INJ as a top cryptocurrency for its native token, offering significant value to users and traders.

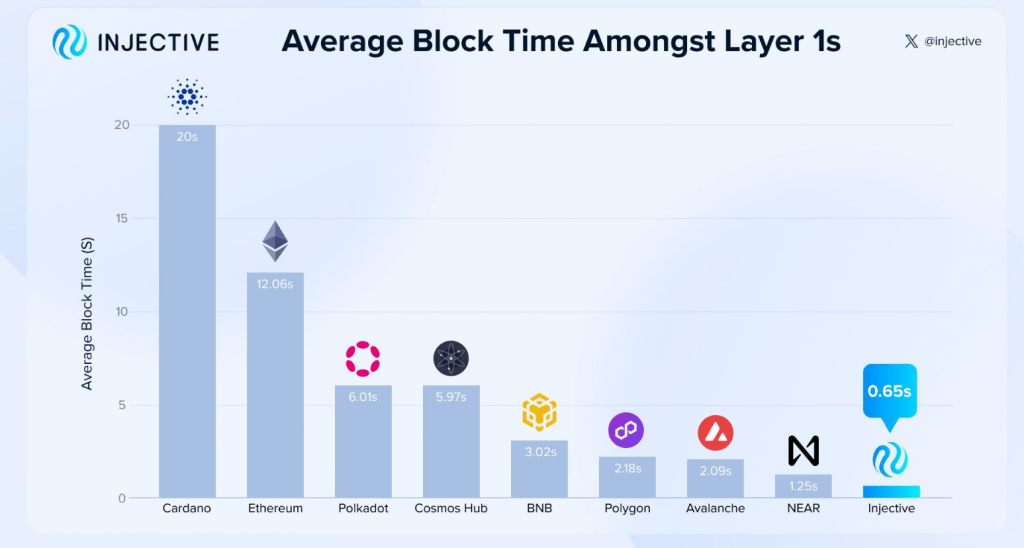

‘Fastest Layer 1 Blockchain’ Slashed Blocktimes To Just 0.65 Seconds

Injective recently announced a notable achievement by reducing finality times to an impressive 0.65 seconds. A comparison of the platform’s finality times with other layer 1 blockchains such as Near, BNB, and Ethereum showcased its remarkable speed. The network’s optimized state synchronization, data handling, and resource management have contributed to this milestone.

1/5 Injective continues to push the boundaries of blockchain scalability, with recent upgrades delivering the fastest speeds imaginable.

Injective block times have now been slashed to just 0.65 seconds, making it one of the fastest layer 1 blockchains ever created ⚡️ pic.twitter.com/lFN3W1w2Ve

— Injective 🥷 (@injective) August 21, 2024

This achievement enhances the on-chain user experience and provides developers with a robust platform for building. Injective is also eyeing the institutional sector of the crypto market. The ultra-low block times are set to attract traditional financial institutions to the platform with speeds comparable to leading crypto networks.

Injective Integrates With Balance, Expanding Network Services

Injective’s recent integration with Balance, a cross-chain decentralized finance platform (DeFI), on the Injective mainnet has opened up new avenues for investors and traders. This integration introduces assets like bnUSD, Balance’s native stablecoin, providing additional investment opportunities.

Furthermore, the partnership allows for overcollateralized loans on the platform, enabling users to utilize any asset as collateral and receive up to two-thirds of its value as a loan. With a low fixed interest rate of 2%, users can benefit from flexible loan terms and quick block time finality on Injective.

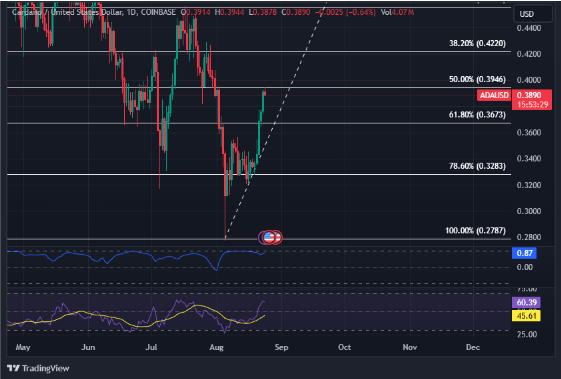

INJ Faces Rejection On This Level, But With A Possible Rebound

Currently, INJ’s momentum, while predominantly bullish, is encountering resistance at the $0.39 level, leading to a narrow trading range of $0.36-$0.39. This range may put pressure on the bullish trend in the short term.

Related Reading

With the current correlation between INJ and Bitcoin, coupled with recent developments, the bullish sentiment for INJ may be nearing exhaustion, potentially leading to a downward trajectory in the near future.

In light of the relative strength index indicating exhaustion or near-exhaustion of bullish momentum, investors and traders should anticipate bearish attempts to breach the $0.36 support level before stabilizing within the current trading range. Failure to defend this range may result in a retracement back to $0.32 for Injective.

Featured image from Snopes, chart from TradingView