Yesterday, August 5, LINK, the native currency of Chainlink, a decentralized Oracle provider, plunged to a six-month low. Changing hands at around $8, LINK fell by 64% from March highs, breaking out from a bull flag, signaling weakness. The correction was across the board, and leading altcoins like Solana and Cardano also posted sharp losses.

LINK Holders Accumulating, Outflows From Exchanges Spike

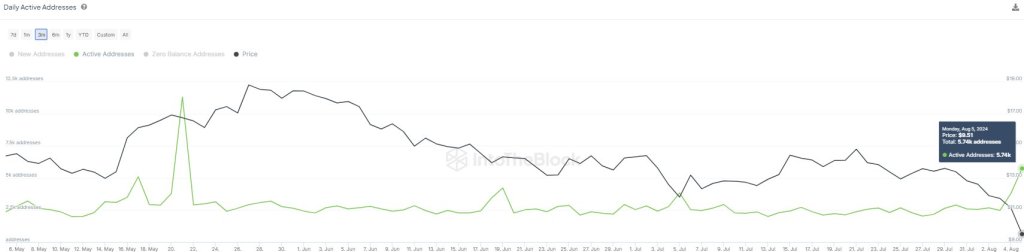

The recent plunge in LINK’s price presents an opportunity for smart investors to accumulate. IntoTheBlock data on August 6 showed a significant increase in the number of active LINK addresses, indicating a strong interest in accumulating the cryptocurrency despite the market downturn.

Related Reading

The rise in active addresses was accompanied by a notable spike in outflows from exchanges, suggesting that holders were more inclined to accumulate LINK rather than sell, despite the falling prices.

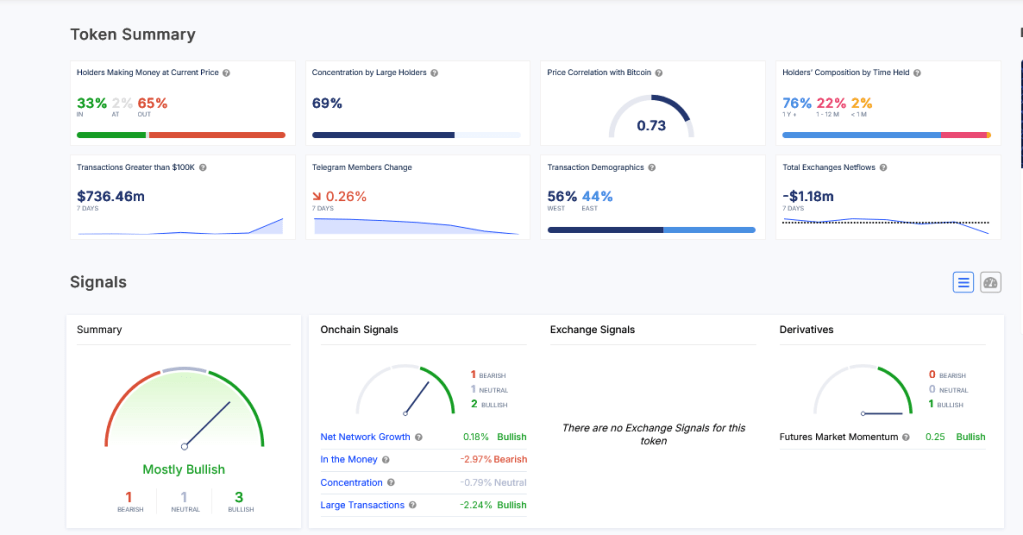

Outflows from centralized exchanges like Binance and Coinbase indicate a positive sentiment among users, as holding LINK in non-custodial wallets limits the ability to sell quickly for other assets.

Historically, crypto prices tend to recover strongly after periods of extreme fear, especially for assets like LINK. The market crash in March 2020 saw a similar scenario, where aggressive investors capitalized on the opportunity to buy during the dip.

Given the current trend of outflows from exchanges and accumulation by holders, it is likely that LINK will experience a strong bounce back in the near future.

Most Holders Are In Red, But Partners Are Interested In Chainlink Solutions

Data from IntoTheBlock reveals that a majority of LINK holders are currently at a loss, with only a small percentage in profit. However, long-term holders, known as “diamond hands,” have been holding onto their LINK holdings for over a year.

The resilience of prices during sell-offs is often attributed to the presence of long-term holders who maintain their positions even in volatile market conditions.

Aside from the price dynamics, optimism remains high among LINK holders due to Chainlink’s role as a leading decentralized oracle provider servicing DeFi and NFT protocols.

Related Reading

Chainlink Labs, the developer behind Chainlink, continues to establish partnerships, with recent integration of Chainlink’s Proof-of-Reserve on Ethereum by 21Shares to enhance transparency in the ecosystem.

Feature image from DALLE, chart from TradingView