This article also available in English.

Decentralized finance (DeFi) protocol Synthetix (SNX) is embarking on a new journey by working towards the launch of its application blockchain, SNAXChain, as detailed in a blog post from September 4, 2024.

Synthetix SNAXChain To Launch On Optimism’s Superchain Infrastructure

Synthetix, an Ethereum-based derivatives liquidity protocol, will soon introduce SNAXChain, an application blockchain leveraging Optimism’s Superchain infrastructure.

Optimism’s Superchain is a layer-2 scaling network on Ethereum, comprising OP chains that share security features and a communication layer, all powered by an open-source technology stack.

Governed by the Optimism Collective, a decentralized autonomous organization (DAO), the Superchain ecosystem includes existing OP chains like Base, Lyra, Mode, and Zora, with SNAXChain set to join the lineup.

Related Reading

The launch of SNAXChain is poised to enhance the protocol’s efficiency and scalability, ensuring a smoother and more cost-effective experience for DeFi users engaging in the issuance and trading of synthetic assets. Additionally, SNAXChain will bolster Synthetix’s liquidity to meet the increasing demand for synthetic assets.

The Synthetix team describes SNAXChain as a neutral hub for on-chain governance and protocol decisions while also planning to expand to other blockchain networks and layer-2 solutions in the future.

In terms of infrastructure management, Synthetix has partnered with Conduit, and Wormhole will facilitate cross-chain messaging between SNAXChain, Optimism, and the Ethereum mainnet.

With the launch of SNAXChain, Synthetix will initiate a new governance epoch, inviting interested individuals or groups to nominate themselves for various governance councils on the new application blockchain. The process involves bridging a small amount of Ethereum (ETH) for gas, connecting wallets to the Synthetix governance app, and nominating oneself for the desired council. Voting for the Synthetix governance council is scheduled to commence on September 6, 2024.

Can DeFi Make A Comeback?

Despite the ongoing development and innovation in the Ethereum DeFi space, particularly with the introduction of layer-2 scaling solutions like Optimism and Arbitrum, the industry has not experienced the same fervor observed during the ‘DeFi summer’ of 2020.

However, recent on-chain data suggests a potential resurgence of DeFi later this year. For instance, Optimism has seen increased network activities, leading to a 9% surge in its native OP token price. As the network expands, user engagement is likely to rise further.

Related Reading

Similarly, Uniswap, a prominent decentralized exchange (DEX), has generated a total revenue of $50 million, underscoring the undervaluation of its native UNI token which is currently down 86% from its all-time high.

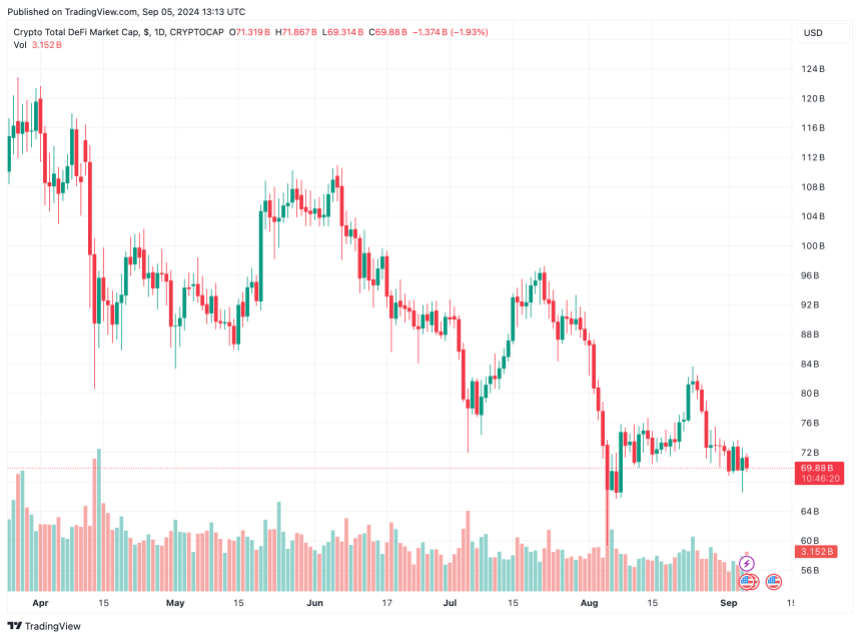

Additionally, AAVE, one of the earliest DeFi lending protocols, has witnessed renewed interest from large crypto investors. The total DeFi market cap stands at approximately $69.88 billion.

Featured Image from Binance Academy, Chart from TradingView.com