The recent surge in the cryptocurrency market on February 23rd, particularly with Uniswap’s native token, UNI, rising by 71%, highlights the evolving dynamics within the crypto space. This significant increase, marking UNI’s highest price point since March 2022, has sparked renewed interest in decentralized finance (DeFi) and brought attention to innovative proposals.

Source: Coingecko

Uniswap Proposes Fee-Sharing Feast For Stakers

The driving force behind UNI’s surge seems to be Uniswap Foundation’s proposal for a fee-sharing mechanism, aiming to redefine the token’s utility and incentivize long-term engagement within the Uniswap ecosystem. This proposal introduces a novel way for UNI holders who stake their tokens to earn a share of the fees generated by the Uniswap protocol, empowering them to participate in governance decisions.

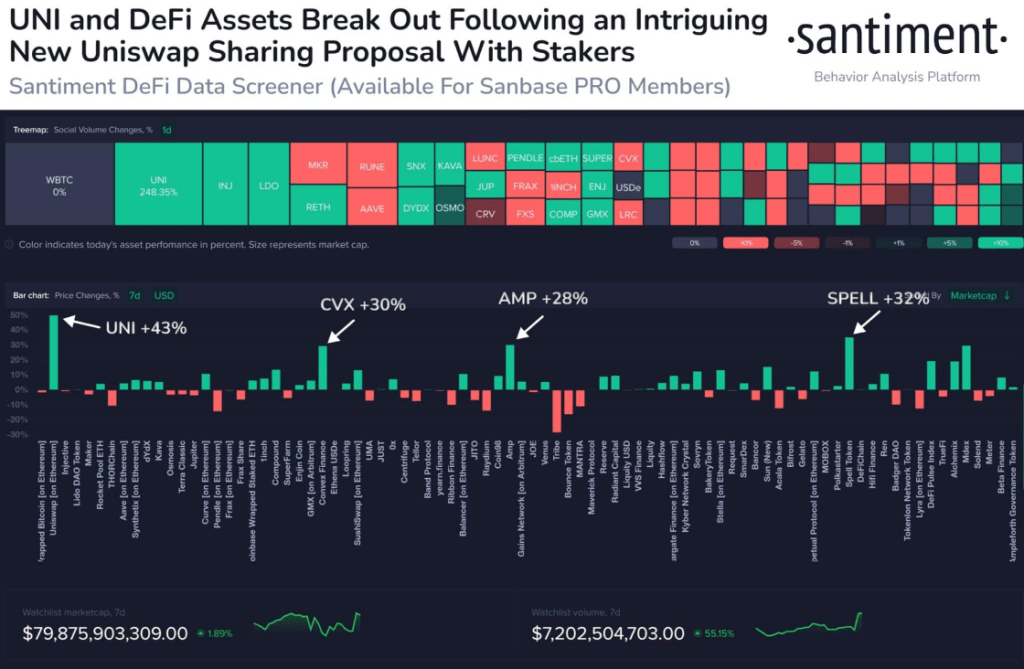

The DeFi sector’s resurgence, as indicated by the increase in value of assets like $COMP, $SUSHI, and $AAVE alongside UNI’s surge, underlines a broader trend towards decentralized financial products. This shift has not only impacted token prices but also led to significant growth in trading volumes across various decentralized protocols.

Trade Volumes On A Roll

The impressive surge in trading volumes for protocols such as COMP and SushiSwap, coupled with price increases, reflects the growing interest in DeFi solutions and a possible transition of capital within the market.

UNI currently trading at $12.16 on the daily chart: TradingView.com

Uniswap v4 Upgrade On The Horizon: Efficiency And Customization Beckon

The anticipation around the upcoming Uniswap v4 upgrade, scheduled for release in Q3 of 2024, adds further momentum to UNI’s bullish trajectory. This upgrade is expected to improve the protocol’s efficiency and adaptability, catering to the evolving demands of the DeFi space.

Although the direct impact of the v4 upgrade on current price movements is uncertain, its potential to revolutionize the Uniswap ecosystem contributes to the positive sentiment surrounding UNI.

Beyond Uniswap: DeFi Dominance On The Rise?

The ripple effects of Uniswap’s fee-sharing proposal and the forthcoming v4 upgrade extend beyond UNI, highlighting the broader potential for DeFi protocols like Blur and Lido Finance to experience similar growth. This trend underscores the increasing significance of DeFi in the cryptocurrency landscape, attracting investors looking for innovative financial solutions outside traditional centralized systems.

Featured image from Adobe Stock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell, or hold any investments. Investing carries risks, and it is advisable to conduct thorough research before making any investment decisions. Use the information on this website at your own discretion and risk.